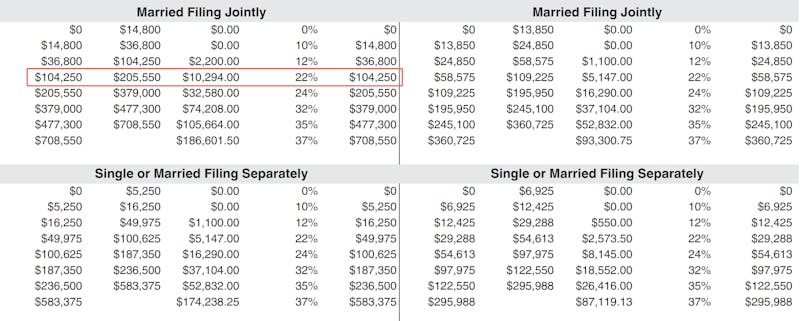

Tax Withholding Estimator 2024 – The IRS has developed a calculator, called the Tax Withholding Estimator, that accurately predicts how much federal taxes you will need to pay each year, based on your current income and filing status . To avoid these penalties, employees and many retirees typically have taxes withheld from paychecks or Social Security and pension payments before year-end. The Internal Revenue Service has posted a .

Tax Withholding Estimator 2024

Source : www.nerdwallet.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govHow To Calculate Your Federal Taxes By Hand · PaycheckCity

Source : www.paycheckcity.comYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comIRS Tax Withholding Estimator helps people get ready for the 2024

Source : www.payrollpartners.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comTimothy Glenn on LinkedIn: Proactively Prepare for the 2024 Tax

Source : www.linkedin.comTax Calculator: Income Tax Return & Refund Estimator 2023 2024

Source : www.hrblock.comFree Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.comIRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.orgTax Withholding Estimator 2024 W 4: Guide to the 2024 Tax Withholding Form NerdWallet: Your refund is money that rightfully belonged to you all year long that the IRS has been collecting and holding. . He advises using the IRS’s tax withholding estimator, which will pre-populate a W4 you can give to your employer’s HR department. “Have your W4 adjusted,” says Lucas. “This will help avoid unnecessary .

]]>